Taxable Flag

A Taxable flag should be set to either a Yes or No to ensure that taxes are charged properly.

There are three places in the system to manage tax flags:

- Property Set-up screen - This screen contains two separate flags to accommodate the two different types of ESI IDs - Continuing Service Agreement (CSA) units and Common Area Agreement (CAA) locations.

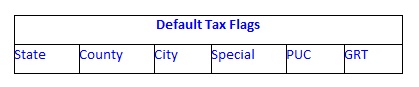

- Customer Level Default Tax Flags - This acts as the default value for ESI IDs once the Property goes live in the system and CSA units are flowing on and off with the Property.

- Premise Control - This contains the ESI IDs that are enrolled on the Property. Each ESI ID contains its own set of tax flags. ESI ID level flags determine whether or not a Customer receives taxes for that particular ESI ID. See Edit Premise Information in Using Utility Accounts Tab.

The Tax Flags work in the following manner:

- When a property is established initially, the Property Set-up flags are set to indicate the tax status for the CSA unit Default Tax Flags located on the Customer Summary screen. It also sets the tax status for both the CSA and CAA flags at the ESI ID level.

- Changing the Property Set-up flags only affects the CSA unit Default Tax Flags on the Customer Summary screen. Once the ESI ID flags are set, either open the ESI ID Detail box for each ESI ID and change the flags one at a time or open a CM request with a spreadsheet attached to it. The spreadsheet has Customer account numbers listed whose ESI IDs need to be changed.

- Changing the CSA unit Default Tax Flags on the Customer Summary screen causes the Property Set-up flags CSA unit flags to change as well. These two should always stay in sync.

Tax exemption certificates serve as proof that a Customer is exempted from Sales tax. If a property is tax exempt when it was initially set up, the ESI ID flags should be set correctly from the start. If you have to change the tax exemption status after you set up the property, change the flags on the Property Set-up screen and open a CM request to have the ESI ID flags changed by CIS.

A Property who provides proof of tax exemption status has the following configuration of

taxes:

State- appears uncheckedCounty- appears uncheckedCity- appears uncheckedLocal (MTA/SPD)- appears uncheckedPUC- appears checkedGRT- appears checked Note: PUC and Gross Receipts Taxes (GRT) are not considered sales taxes to the end consumer and therefore are not exempted from taxes.

Note: PUC and Gross Receipts Taxes (GRT) are not considered sales taxes to the end consumer and therefore are not exempted from taxes.